The Riches Report Blog

New State Pension Tax Threat: Rachel Reeves' Upcoming Income Raid

In a move that could impact millions of state pensioners, Chancellor Rachel Reeves is reportedly planning an extended income raid in her upcoming Spring Statement on March 26. This decision comes as Reeves struggles to balance the books following her controversial autumn Budget.

Retirement Budgeting

Having retired many people over the years, in the strictly “non-mafia” sense of course, I typically find it takes clients 24 months to adjust to a regular pattern of spending as they acclimatize to this next, hopefully long and fulfilling phase of their lives. Determining how much people should realistically expect their spending to be in retirement has always been a challenge.

What's Your "Number?"

In the 2010 US drama Wall Street 2: Money Never Sleeps directed by Oliver Stone, Shia LaBeouf turns to Josh Brolin and asks him “what’s your number?” to which Brolin’s character, Bretton James, famously responds with “more”!

Meanwhile back in the real world of financial planning, we can be a little more scientific, particularly with the use of planning tools such as cashflow modelers. In this world, your “number” really is the age at which financial independence is attained, meaning the point beyond which you continue working is through choice rather than necessity.

In this blog, we’ll explore a typical approach to determining your “number.”

We Should Ban Risk Profilers: Prove Me Wrong

Risk profiling has become a cornerstone of modern investing, if not an industry in its own right but is it really serving investors' best interests? I argue that risk profilers should be banned.

The power of compounding over time

In Indian folklore, a minister and wiseman called Sessa, apparently invented chess for his King, and in return asked for payment in grains of wheat: one grain on the first square, two on the second and doubling each square thereafter. The King laughed at him, for asking for such a small prize, obviously not realising that on the 64th square it would be 263 (i.e. two to the power of 63, or 9,223,372,036,854,780,000) grains of wheat! It was Sessa who got the last laugh.

Understanding and managing ‘sequence risk’

Most investors are concerned about the future returns of their portfolio, despite the expectation that a well-structured, globally diversified balanced portfolio should yield positive returns after inflation over most 10- and 20-year periods.

When an investor withdraws money from their portfolio regularly, such as to fund their retirement lifestyle, the sequence of portfolio returns they experience can significantly impact financial outcomes, even if the average return is as expected. This phenomenon is known as 'sequence risk’. However, if no withdrawals are made, the order of returns does not affect the outcome, because 3 X 2 X 1 yields the same result as 1 X 2 X 3.

Why does withdrawing money from a portfolio make a difference?

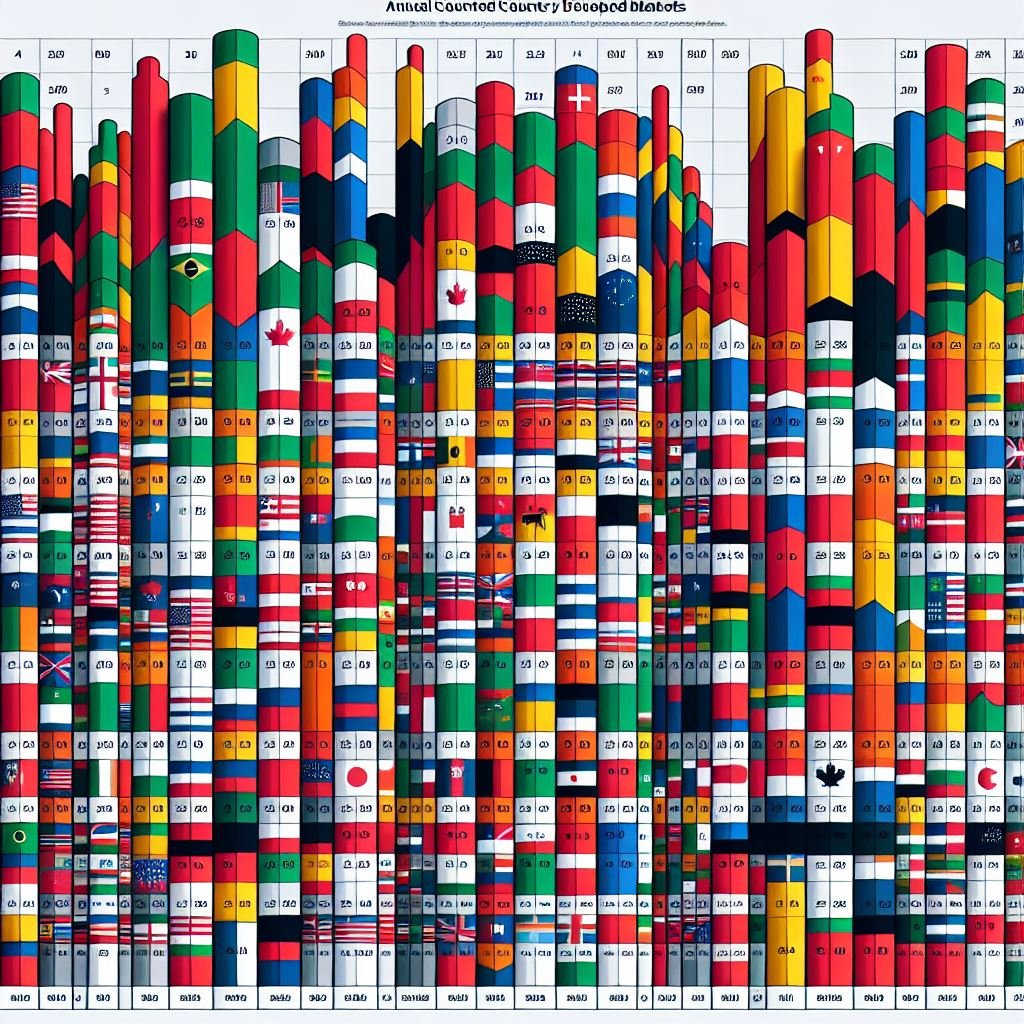

Which Country Will Outperform? Here’s Why It Shouldn’t Matter.

Investment opportunities exist all around the globe, but the randomness of global stock returns makes it exceedingly difficult to figure out which markets are likely to be outperformers. How should investors deal with this kind of uncertainty?

Tariffs and Stagflation

One of the concerns arising from tariff talks is the possibility of stagflation, or the combination of rising inflation and an economic contraction. But should investors act on this concern with their investments?

Controlling Your Reptilian Brain

Being an investor is not easy. We must contend not only with the erratic and unpredictable nature of markets but also with the sometimes erratic and irrational ways in which we are tempted to think and behave. Today’s many and varied temptations include Bitcoin, the ‘Magnificent Seven’ tech stocks in the US, and gold. All are at our fingertips at the press of a button on our phones. As Benjamin Graham, one of the great investment minds of the twentieth century, famously stated (Graham and Dodd, 1996):

The Great Raid

The Chancellor is reportedly preparing to announce significant changes to the rules governing Cash ISAs, aiming to reform financial services and boost economic growth. Rachel Reeves, who confirmed last month that she is considering new curbs on Cash ISAs, believes that encouraging savers to invest their money elsewhere, such as in the stock market, could be more productive for the UK economy.

Navigating the Storm: The Impact of Geopolitical Events on Financial Markets

In today's interconnected world, geopolitical events have a profound impact on global financial markets. From wars and elections to trade agreements and policy changes, these events can cause significant volatility and uncertainty. Understanding how these events influence markets is crucial for investors looking to navigate the ever-changing landscape. In this blog, we'll analyse the impact of major geopolitical events on financial markets and provide insights on how investors can manage these uncertainties.

Evidence-Based Investing: Making Smart Financial Choices

In the world of investing, making informed decisions is crucial for achieving long-term financial success. Evidence-based investing (EBI) is an approach that emphasises making investment choices based on empirical evidence and rigorous research rather than speculation or market timing. This method has gained popularity for its focus on data-driven strategies and its potential to deliver consistent risk-adjusted returns. In this blog, we'll explore the principles of evidence-based investing, provide examples, discuss how it can be implemented today, and highlight its characteristics and risks as an investment strategy.

Managing the Six Biggest Financial Concerns of Senior Re/Insurance Executives

Having spent 25 years working with dozens of senior executives in the fast-paced world of re/insurance, many often find themselves asset-rich but time-poor. Managing personal finances can easily slip to the bottom of the to-do list, especially when faced with the unique challenges of the industry. This blog post explores the six biggest financial concerns of senior re/insurance executives and offers strategies to address them effectively.

Navigating the Five Key Risks in Retirement: A Comprehensive Guide

Having “retired” hundreds of people over the last 25 years – in the strictly non-mafia sense of the term of course – I thought I’d share some the most significant risks individuals often overlook as they embark on this next, next and exciting phase of life.

Inflation - a Sticky Subject

Inflation has been a persistent issue in the UK in recent times, despite 14 consecutive interest rate hikes since 2022 – the traditional response to rising prices. Recently, it was announced that inflation has risen to 3%, defying some. In this blog post, we will explore the main causes of the current UK inflation (CPI), the options available to the UK Government and HM Treasury to combat it, and the impact of rising inflation on household finances, the value of money, and investment portfolios.

Avoid These Pitfalls: Top 5 Tax Efficiency Mistakes to Watch Out For

In the quest for tax efficiency, it's easy to make mistakes that can cost you dearly. Here are the top 5 mistakes people often make when trying to optimise their tax situation:

Taking Care of Mum and Dad: Navigating Elderly Care in the UK

Over the past 50 years, social care in the UK has undergone significant changes. From the establishment of the National Health Service (NHS) in 1948 to the introduction of the Care Act 2014, the focus has shifted towards providing comprehensive support for the elderly. Today, there are approximately 400,000 people living in residential care homes in the UK, with numbers projected to rise due to an ageing population. The average stay in a care home is around 30 months, with the average age at entry being 85 years. Care home fees have been increasing annually, with typical rises of around 4-5%.

The Crypto Craze: Understanding Cryptocurrency and Its Impact

Cryptocurrency has taken the financial world by storm, becoming a hot topic of discussion among investors, tech enthusiasts, and everyday individuals alike. But what exactly is cryptocurrency, and why is it generating so much buzz? In this blog, we'll delve into the world of cryptocurrency, exploring its origins, how it's created, valued, and traded, the top three most popular cryptocurrencies, the technology behind it, and its regulatory landscape. We'll also discuss its suitability for individual investors.

Advisers beware: Navigating the Speculation Around Pensions and Inheritance Tax

In recent weeks, there has been a flurry of media speculation regarding the potential introduction of Inheritance Tax (IHT) on pensions after April 2027. This has understandably caused concern among many of our clients, who are worried about the possibility of double taxation—being subject to both IHT and income tax in the hands of a non-spouse beneficiary. However, it's important to note that, as of now, there has been no official confirmation from HMRC or HM Treasury on this matter.

Smart Tax Strategies: How to Keep More of Your Money in the UK

In today's high taxation environment in the UK, individuals and businesses are facing significant changes and challenges. With recent adjustments to National Insurance, stamp duty thresholds, and capital gains tax, it's more important than ever to manage personal finances in a tax-efficient manner. Here are the top 7 tax efficiency tips to help you navigate this complex landscape: